ev charger tax credit 2022

Compare Homeowner Reviews from 6 Top Westfield Electric Vehicle Charging Station Installation. Here are the key things to know.

Go Electric Oregon Program Oregon Ev Tax Incentives Mercedes Benz Of Portland

Ad Homeowners and businesses who install an EV charger may qualify for rebates and incentives.

. The credit is for 30 of the combined cost of the hardware and installation capped at 1000. How much is the. Iowa EV tax rebate.

This is the same as what it used to be. Hire the Best Vehicle Charging Station Installers in Westfield NJ on HomeAdvisor. Maine electric vehicle rebates.

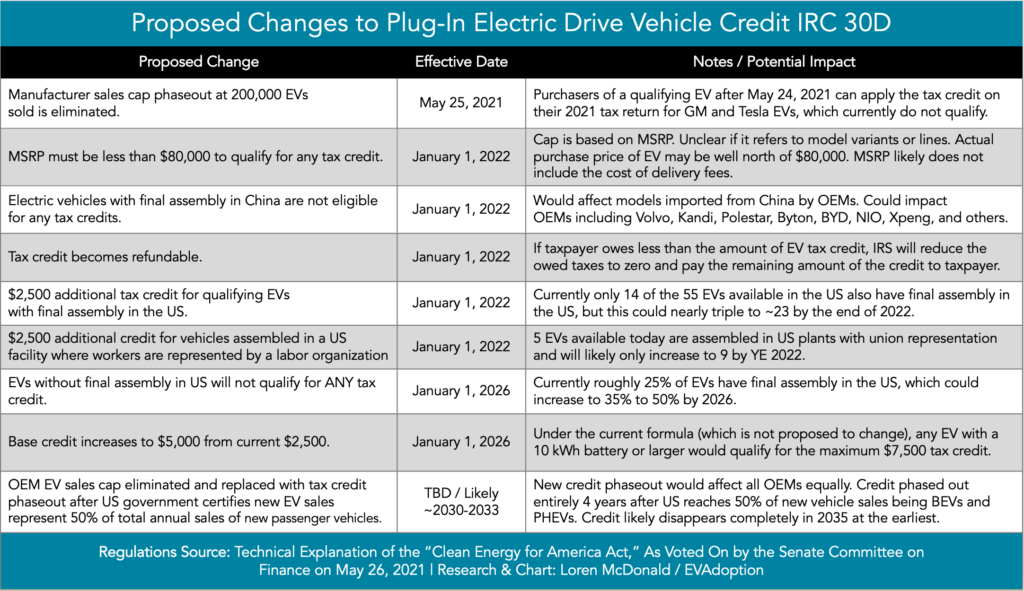

If you are interested in claiming the tax credit available under section 30D EV. Technically referred to as the Alternative Fuel Vehicle Refueling Property Credit the Section 30C tax credit will come back into force for charging stations placed in service. EV Tax Credit Expansion.

Do I Need a Permit to Install an EV Charger. Ad Cover up to 60-100 of EV charging equipment and project costs. October 12 2022.

The federal government offered an EV charger tax credit known as the Alternative Fuel Infrastructure Tax Credit for equipment and installation. See if you can receive a rebate for installing an EV charger in your home or business. The tax credit works by offering a tax credit of 30 of all costs you have incurred by purchasing and installing EV chargers up to 1000 total credit.

The F-150 Lightning is currently the only electric full-size pickup on the market and its a huge hit. EV Charger Tax Credit 2022. New Jerseys DriveGreen Program offers Level 2 and DC Fast Charger incentives.

Save up to 1000 on charging your EV at home. With the renewed Alternative Fuel Vehicle Refueling Property Tax Credit businesses can again receive a 30 tax credit up to 30000 per property. The tax credit for a.

Tucked inside the massive Inflation Reduction Act of 2022 that was signed into law in August is a complex set of requirements around which EVs and other clean vehicles do and do not qualify. Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30000 which still applies to projects completed before the end of. Compare Homeowner Reviews from 8 Top Middletown Electric Vehicle Charging Station Installation.

Federal tax credit gives individuals 30 off a ChargePoint Home Flex electric vehicle charging station plus installation costs up to. 2022 EV Tax Credits. New Jerseys DriveGreen Program offers Level 2 and DC Fast Charger incentives.

Illinois offers a 4000 electric vehicle rebate instead of a tax credit. When President Biden signed the Inflation Reduction Act on August 17 a new rule took effect requiring that final assembly of EVs must occur in North. Hire the Best Vehicle Charging Station Installers in Middletown NJ on HomeAdvisor.

Youll have to keep its total price under 80000 to qualify for the new tax credit. The Federal 30C Tax Credit was renewed as part of the Inflation Reduction Act IRA of 2022. It provides a valuable incentive for installing EV charging-related hardware.

October 11 2022. The EV Charger Tax Credit Gets A 10-Year ExtensionAnd A Few Upgrades. Use Our Return Calculator.

Your Business May Be Eligible For Employee Retention Tax Credit. Increase employee engagement and retention with workplace EV charging. Best Credit Cards 2022 Best Travel Credit Cards Best Airline Credit Cards.

This is a one-time. Ad EV charging is good for the planet and good for business. Find Out If You Qualify.

March 16 2022 Many Americans save their tax refund or use it to chip away at debt but advance payments of the Child Tax Credit in late 2021 filled a. Maryland offers a tax credit up to 3000 for qualified. Next EV Charger Tax Credit 2022 Next.

Updated information for consumers as of August 16 2022 New Final Assembly Requirement. Ad Cover up to 60-100 of EV charging equipment and project costs. Ad File Your IRS Taxes Online - Free.

The Alternative Fuel Vehicle Refueling Property Credit the Section 30C tax credit will come back into force for charging stations placed in service after December 31 2022. Ad The IRS Is Giving Businesses Up To 26k Tax Credit Per Employee. Taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed in their homes after December 31 2021.

Federal EV Charging Tax Credit. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10. The Alternative Fuel Infrastructure Tax Credit.

Technology Performance 420 V lithium-ion battery with 705 kWh battery capacity 75 hours 10 - 100 charging time 240V wall box 32 minutes 10 - 80 charging time DC fast charging.

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Ev Charger Tax Credit 2022 Wattlogic

All About Tax Credits For Installing Electric Vehicle Charging Stations Ev Connect

Ev Charging Station Tax Credits Are Back Inflation Reduction Act Extension Of The Section 30c Tax Credit Blogs Renewable Energy Outlook Foley Lardner Llp

Qualifying Cars For The 2022 Electric Vehicle Tax Credit Verified Org

3 Ev Charging Stocks That Could 10x By 2030 Investorplace

Impact Of Proposed Changes To The Federal Ev Tax Credit Part 1 Summary Chart Evadoption

Ev Charger Tax Credit 2022 Wattlogic

Inflation Reduction Act Ev Tax Credit Ev Buyers Receive Up To 7 500

Electric Vehicle Incentives Are Getting A Total Makeover The Boston Globe

How Much Does It Cost To Install An Ev Charger Carvana Blog

Rebates And Tax Credits For Electric Vehicle Charging Stations

Ev Tax Credit What It Means For Car Buyers And The U S Auto Industry

Every Electric Vehicle Tax Credit Rebate Available By State

Exclusive U S Automaker Ceos Toyota Urge Congress To Lift Ev Tax Credit Cap Reuters

Ev Tax Credits Are Changing What S Ahead Kiplinger

Electric Car Tax Credit 2022 10 Things You Need To Know E Vehicleinfo

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

New Clean Vehicle Tax Credit Plan Means Most Evs No Longer Qualify Forbes Wheels